Effortless and Swift Company Formation in Bahrain: Unlock Business Success in 7 Simple Steps

Embarking on the journey of company formation in Bahrain is now more streamlined than ever, thanks to the innovative reforms introduced by the Ministry of Industry and Commerce. Recognizing the need for efficiency and user-friendliness, the ministry unveiled Sijilat 3.0 in August 2023, revolutionizing the process and making it easier and faster for businesses to establish themselves. If you’re considering company formation in Bahrain, you can now take advantage of these groundbreaking reforms and experience a smoother and more efficient process. Our team of experts specializes in assisting businesses with company formation in Bahrain, ensuring a seamless and hassle-free experience. Contact us today to learn more about our services and how we can help you navigate the process of company formation in Bahrain.

At the forefront of this transformation is Aventen Group, a distinguished professional Agent in Bahrain. Committed to providing up-to-date and accurate guidance, the company has recently enhanced its comprehensive company formation guide in March 2023 to align with the latest changes and requirements introduced by the Ministry.

The notable improvement includes a significant shift in the procedural requirements. Notably, the need for a Power of Attorney for company formation in Bahrain has been eliminated. This progressive change simplifies the process, allowing entrepreneurs to navigate the formation journey with greater ease and efficiency.

Discover the seamless experience of company formation in Bahrain with Aventen Group. Our expert guide ensures that you navigate through the intricate process effortlessly, meeting all necessary requirements for successful business registration. Fast-track your business establishment with us and embrace the future of entrepreneurship in Bahrain.

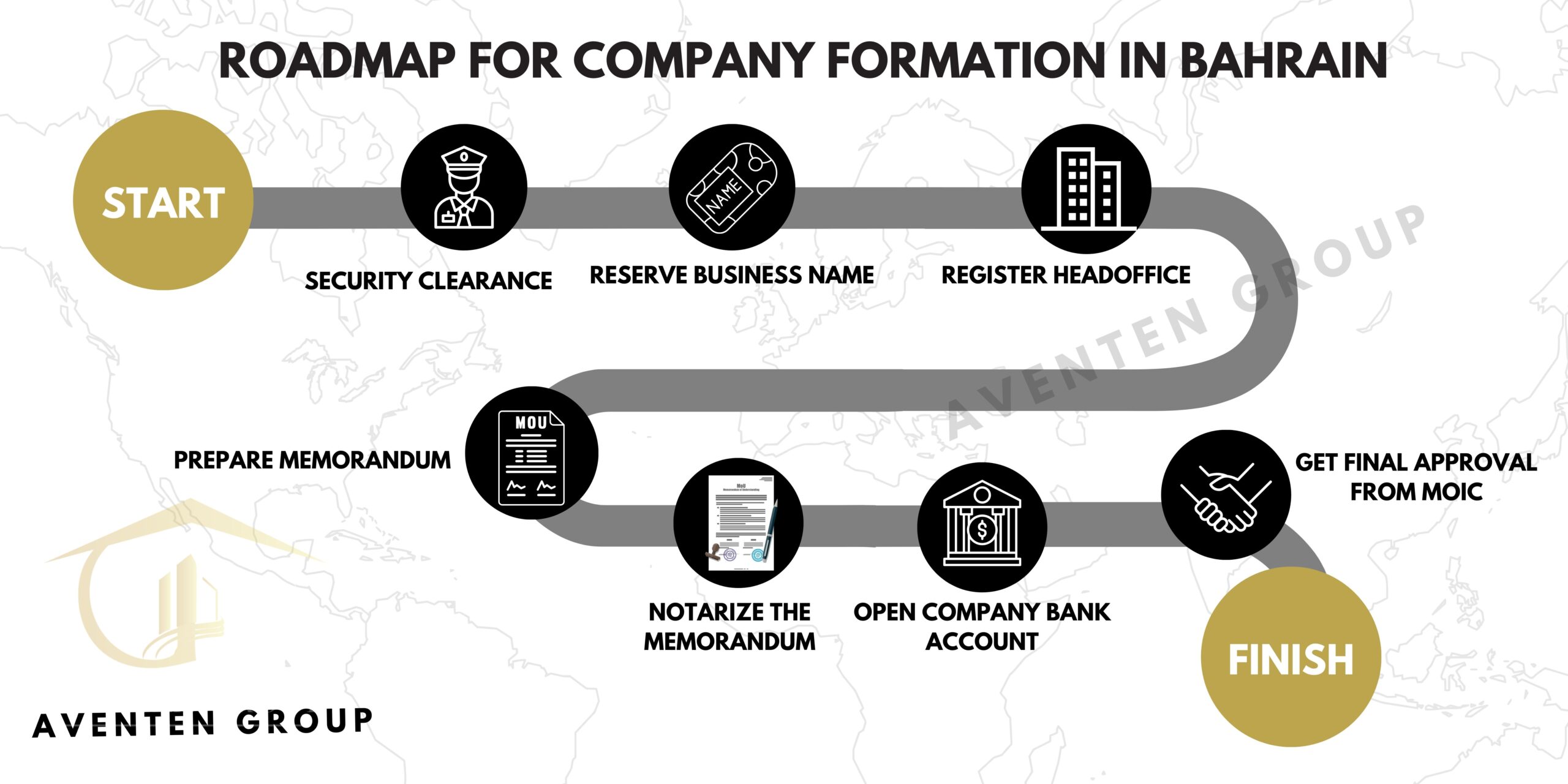

New Procedure for Company Formation in Bahrain: A Comprehensive Guide

Starting a company formation in Bahrain has never been more accessible, thanks to the streamlined process introduced by the Ministry of Industry, Commerce, and Tourism (MOIC). In this article, we will guide you through the new procedure for company formation in Bahrain, breaking it down into seven essential steps. Whether you’re a budding entrepreneur or an established business owner looking to expand, this guide is tailored to make the process smoother and more efficient.

Step #1: Security Clearance

Initiate the process of company formation in Bahrain by securing approval for security clearance. Our dedicated Aventen Group Business Consultant team will meticulously prepare the essential Know Your Customer (KYC) documents tailored to your requirements for swift review and signature. Once signed, we submit your IDs to the Nationality Passport and Residency Affairs in Bahrain for approval. Required documents at this stage include:

- Clear copies of passports

- Duly signed KYC forms

- Duly signed Engagement letter

- Authorization letter

Step #2: Reserve Commercial Name

Following the successful acquisition of security clearance, our team seamlessly advances to reserve your commercial name, a pivotal step in the company formation in Bahrain process. Adhering to our meticulous approach, we consistently draft the necessary Know Your Customer (KYC) documents and submit them for approval. The required documents at this stage remain consistent, ensuring a streamlined and efficient process for your company formation in Bahrain. Required documents at this stage remain consistent:

- Clear copies of passports

- Duly signed KYC forms

- Duly signed Engagement letter

- Authorization letter

Step #3: Register Head office of the Company

Following name reservation, our team applies for approval of your company’s head office it a next step in company formation in Bahrain. This involves securing approval for your office/shop/workshop incubator’s commercial address. We assist you in finding the most suitable business location based on your requirements. To register the head office, we require the following documents:

Following name reservation, our team applies for approval of your company’s head office. This involves securing approval for your office/shop/workshop incubator’s commercial address. We assist you in finding the most suitable business location based on your requirements. To register the head office, we require the following documents:

- Shop Photos (Pre-Approval)

- Lease Agreement (After approval)

- EWA (After approval)

Step #4: Prepare Memorandum of the Company

The pivotal step in company formation in Bahrain involves drafting the Memorandum of Association and Articles of Association. Our Aventen Group Business Consultant team crafts clauses tailored to your specific business structure. Once the draft is confirmed by you, we submit the documents to the Ministry of Industry, Commerce, and Tourism (MOIC) for approval and further processing.

Step #5: Notarize the Memorandum

Following MOIC approval,the next step in company formation in Bahrain is legal documents undergo attestation by a public or private notary. Our Aventen Group Business Consultant team manages the entire notary attestation process on behalf of our clients.

Step #6: Open Company Bank Account

In compliance with Bahraini regulations, opening a company bank account is mandatory for company formation in Bahrain. Our Aventen Group Business Consultant team facilitates this process by assisting you in opening an account in your company’s name and depositing the required capital. The company bank account opening requirements include:

- A bank statement covering the last six months of business activity, sealed on each page for authenticity.

- Physical presence of all company shareholders at the designated bank branch.

- Supporting documents demonstrating the source of income, such as business bank statements or employee salary slips.

- A business summary outlining the nature and scope of your business, along with a financial plan projecting expected revenue and expenses.

Company Bank Account Features:

Online Banking Facility:

- Enjoy the convenience of managing your company’s finances anytime, anywhere with our robust online banking platform.

Multiple Authorized Signatories (singly/jointly):

- Empower your business by designating multiple signatories, whether for individual or joint authorization, providing flexibility and control.

International Wire Transfers Facility:

- Seamlessly conduct international transactions with our efficient and secure wire transfer services, ensuring global connectivity for your business.

Trade Finance Services:

- Unlock opportunities for growth with our comprehensive trade finance solutions, tailored to support your company’s import and export activities.

Corporate Debit Card:

- Some banks offer the convenience of a corporate debit card, streamlining day-to-day expenses and facilitating easy access to funds. (Note: Availability may vary between banks.)

Multiple Currency Accounts:

- Optimize your financial strategy with the flexibility of maintaining accounts in multiple currencies, allowing you to navigate diverse markets with ease.

Experience the full spectrum of banking features tailored to meet the unique needs of your business. Contact us to explore how our company bank account can elevate your financial operations.

Step #7: Get Final Approval from MOIC

In the conclusive phase of company formation in Bahrain, the notarized memorandum and the bank certificate are meticulously presented to the Ministry of Industry, Commerce, and Tourism (MOIC) for ultimate approval. Upon the MOIC’s endorsement, your company formation attains official recognition. Below is an illustrative sample of an active Commercial Registration:

Trust Aventen Group Business Consultant for a seamless and efficient company formation in Bahrain experience. Contact us to embark on your business journey with confidence.

Business Opportunities for Foreigners in Bahrain

Unlock a world of possibilities as a foreign entrepreneur in Bahrain, where 100% ownership is not just a prospect but a reality. Here are the enticing benefits that await foreign business owners:

- Secure your foothold in Bahrain with an Investor Resident Permit, offering you stability and ease of operation.

100% Ownership:

- Enjoy the freedom of full ownership, empowering you to shape and steer your business according to your vision.

Family Resident Permits:

- Extend the warmth of your success to your family with the option to obtain Family Resident Permits, fostering a supportive environment.

Employee Resident Permits:

- Facilitate talent acquisition by securing Employee Resident Permits, ensuring a skilled and diverse workforce for your business.

Government Support for the First 2 Years:

- Benefit from governmental backing during the critical initial years, providing a solid foundation for your business to thrive.

No Audit for the First Year:

- Navigate your business launch with ease as the first year enjoys exemption from audit requirements, allowing you to focus on growth.

No Income Tax:

- Relish the advantage of a tax-friendly environment with no income tax implications on your business earnings.

No Corporate Tax:

- Experience the financial advantage of no corporate taxes, contributing to increased profitability and financial flexibility.

Easy Closing Within 2 Years:

- Should the need arise, appreciate the streamlined process of closing your business within a two-year timeframe, ensuring flexibility and responsiveness to market dynamics.

Seize the opportunity to establish and grow your business in Bahrain, where a supportive business ecosystem welcomes you. Embrace a journey of success with these enticing advantages designed to fuel your entrepreneurial spirit.

With Limited Liability Company WLL

For foreign investors, WLL Company formation in Bahrain is the best approach to enter the GCC Market. It is similar to LLC in other countries. This structure limits the risk with the limited liability of the shareholders. It is governed by the Commercial Companies Law of Bahrain which meets International standards. WLL company formation is welcomed by the Bahraini government and the investors are awarded investor resident permits.

For foreign investors, WLL Company formation in Bahrain is the best approach to enter the GCC Market. It is similar to LLC in other countries. This structure limits the risk with the limited liability of the shareholders. It is governed by the Commercial Companies Law of Bahrain which meets International standards. WLL company formation is welcomed by the Bahraini government and the investors are awarded investor resident permits.

Why Choose Aventen Group as Your Partner for Company Formation in Bahrain?

While SIJILAT offers an efficient application processing and approval system for prospective investors, delving into the intricacies of company formation can be overwhelming for those initiating their business journey.

This is precisely where the Aventen Group, a Business Consultant, steps in to assist. Our services offer a seamless path to establishing your business in the Kingdom of Bahrain, eliminating inconveniences. With a dedicated team of professionals specializing in company formation in Bahrain and commercial business registration, you can redirect your focus to other crucial business tasks, saving valuable time and effort.

Simply reach out to us, and our consultants will guide you through the entire process, discussing details and providing insights into the optimal organizational structure aligning with your business goals.

The Aventen Group, a Business Consultant, has been instrumental in lawfully registering numerous local and foreign-funded businesses in Bahrain. Now, it’s your turn! Contact us with confidence to initiate the setup of your business in the thriving hub of the Middle East. Your success story begins with Aventen Group.

Why Choose Bahrain for Company Formation?

Initiating the process of company formation in Bahrain signifies the commencement of your journey towards materializing your entrepreneurial vision in this dynamic kingdom. The necessity of registration in the commercial registers is pivotal, acting as the gateway for engaging in commercial activities within the Kingdom of Bahrain.

Bahrain’s allure as a business destination is heightened by its 0% Corporate & Income Tax policy, making the establishment of an offshore company in Bahrain exceptionally practical and financially appealing.

Within the comprehensive framework of the commercial register, both local and foreign investors, as well as entrepreneurs, gain the advantage of selecting the most suitable business form. The spectrum ranges from sole proprietorship and partnership to various company structures, with the Limited Liability Company (WLL) emerging as a standout choice for its robust and preferred business structure.

Bahrain’s reputation as an investment-friendly hub is well-established, offering a corporate environment that beckons entrepreneurs and investors alike. Positioned as a key player in the GCC, Bahrain presents abundant opportunities for innovative business ventures and lucrative investments.

The introduction of the new commercial registers system, SIJILAT, has elevated the registration process, offering a user-friendly online submission and approval system. This streamlined approach enhances the efficiency of establishing your business, underscoring Bahrain’s commitment to fostering an attractive business environment. This commitment extends to both local startups and foreign investors, positioning Bahrain as a premier destination for those seeking a prosperous and dynamic business landscape.

Seize the opportunity to register your company in Bahrain, where potential meets possibility. Immerse yourself in a realm of growth and innovation at the heart of the Middle East.

Advantages of Company Formation in Bahrain

Embarking on company registration in Bahrain opens the door to a host of compelling benefits, positioning your business for unparalleled success in the Gulf region. Explore the advantages that make Bahrain a prime destination for entrepreneurs:

100 Percent Foreign Ownership:

- Enjoy the freedom of complete foreign ownership, providing you with full control over your business endeavors.

No Corporate Tax:

- Experience the financial advantage of operating in a jurisdiction with zero corporate tax, maximizing your profitability.

No Income Tax:

- Benefit from a tax-friendly environment where your business earnings remain untaxed, contributing to increased financial flexibility.

No Third-Party Involvement:

- Navigate your business landscape with autonomy, as there is no mandatory third-party involvement, ensuring greater control.

Access to Developed and Emerging Markets:

- Strategically located at the heart of the Gulf, your business gains unparalleled access to both developed and emerging markets.

Businessman Visa:

- Facilitate your business operations with a dedicated Businessman Visa, streamlining your presence in the kingdom.

Work Permits (Employee Visas):

- Attract and retain talent by securing work permits (Employee Visas) for your workforce, fostering a skilled and diverse team.

Exceptional Lifestyle:

- Immerse yourself in an exceptional lifestyle that Bahrain offers, blending modern amenities with rich cultural experiences.

Free Zones Everywhere:

- Leverage the advantage of numerous free zones, providing flexible and conducive environments for various business activities.

Strong Currency:

- Engage in business transactions with confidence, as Bahrain boasts a strong currency, adding stability to your financial operations.

Bahrain’s business-friendly ecosystem, coupled with these advantages, creates a thriving environment for entrepreneurs seeking growth and prosperity. Elevate your business to new heights by choosing Bahrain as your preferred destination for company registration.

Bahrain’s Free Trade Agreements (FTA): Unlocking Global Opportunities

The Kingdom of Bahrain, a hub of international business, has strategically inked five free trade agreements with 22 nations, fostering business opportunities and dismantling trade barriers. These FTAs have played a pivotal role, leading to a remarkable 32.60% surge in imports. Explore the list of Bahrain’s progressive FTAs:

Greater Arab Free Trade (GAFTA):

- Facilitating trade within the Arab region, this agreement enhances economic cooperation among member countries.

GCC Free Trade Agreement:

- Strengthening economic ties within the Gulf Cooperation Council (GCC), this agreement promotes seamless trade among member states.

GCC-Singapore FTA (GSFTA):

- Forging a partnership between the Gulf Cooperation Council and Singapore, this agreement encourages bilateral trade and investment.

GCC-EFTA Agreement:

- Expanding trade relations with European Free Trade Association (EFTA) countries, fostering collaboration and economic growth.

US-Bahrain FTA:

- Cementing economic relations between the United States and Bahrain, this agreement promotes trade and investment between the two nations.

Types of Company Formation in Bahrain:

Bahrain’s legal landscape offers a spectrum of business structures to suit various entrepreneurial visions. If you’ve chosen Bahrain for your business endeavor, explore the diverse company formation options:

Individual Establishment (Sole Proprietorship):

- Ideal for solo entrepreneurs seeking simplicity and autonomy in their business operations.

Single Person Company (SPC / Single Member Company):

- Tailored for businesses with a single owner, offering flexibility and streamlined operations.

Bahraini Partnership Company (BPC / Partnership Company):

- Ideal for ventures with multiple partners, fostering collaboration and shared responsibilities.

With Limited Liability Company (WLL / Private Limited Company):

- A preferred choice for businesses seeking a balance between limited liability and operational flexibility.

Limited Partnership:

- Suited for businesses with a mix of general and limited partners, offering flexibility in management.

Bahraini Shareholding Company (BSC / Joint Stock Company):

- Ideal for large-scale enterprises, providing a structure for diverse ownership and capitalization.

Branch of a Foreign Company:

- Enables foreign companies to extend their operations into Bahrain, leveraging existing brand identity.

Government Entities Facilitating Company Formation in Bahrain: Navigating the intricacies of company formation involves collaboration with various government entities:

- Nationality Passport & Residency Affairs

- Ministry of Industry, Commerce & Tourism

- Ministry of Works, Municipalities Affairs & Urban Planning

- Labor Market Regulatory Authority

- Other licensing authorities specific to the business type

Requirements for Company Bank Account in Bahrain: Streamlined by Our Expertise

Opening a corporate bank account is a crucial step in company incorporation. Our specialized company formation team simplifies this process, ensuring your company’s financial readiness within 1-3 business days. For companies under formation in Bahrain, the following requirements apply:

- Personal presence of all shareholders

- Last 6 months bank statements of all shareholders

- Copy of commercial registration (CR)

- Original identification documents

- Account opening letter by the company

- Capital amount in cash

Choose Bahrain as the launchpad for your business journey, leveraging its strategic FTAs, diverse company structures, and streamlined government support. Partner with us for a seamless company formation experience and explore the endless possibilities in the thriving business landscape of Bahrain.

Timeline for Company Formation in Bahrain

Navigating the intricate steps and approvals involved in company formation typically spans 30-45 working days. Opting for the fast-track process can expedite this timeline to 18-25 working days. The meticulous approach of the Aventen Group Business Consultant team ensures efficient completion, minimizing the time frame and enabling you to kickstart your business promptly.

Cost of Company Formation in Bahrain

The cost of company formation in Bahrain varies based on factors such as company type. For a typical With Limited Liability (WLL) company with the minimum capital requirement, the cost is approximately $2260. However, specialized commercial registrations may incur different costs. Calculate your business license cost with our assistance.

Professional Company Formation Agents in Bahrain

At Aventen Group Business Consultant, we excel in guiding our clients through Bahrain’s corporate landscape, offering startup advisory and specialized company formation services. Our customer-centric approach involves personalized consultations to understand your unique requirements, tailoring our services to ensure a seamless and client-focused experience.

Business Environment of Bahrain for Foreign Investors

Bahrain stands out in the Gulf region as it imposes no geographical restrictions. The entire country operates as a free zone, allowing businesses to set up in any city. While there are restrictions related to certain business activities, Bahrain provides a conducive environment for foreign investors.

Tax Structure in Bahrain

- Corporate Tax: 0%

- VAT: 10%

- Income Tax: 0%

Organizational Structure

- Minimum Shareholders: 1

- Maximum Shareholders: Unlimited

- Requirement of Local Directors: No

- Residency of Directors: Not Required

- Residency of Shareholders: Required by banks

- Residency of Authorized Signatories: Not Required

Capital Requirements

- Minimum Capital: No restriction by law.

- Public Disclosure of Share Capital: Yes.

- Capital in Cash: Allowed.

- Capital in Kind: Allowed.

- Debentures: Allowed for Bahraini Shareholding Companies Only

Public Disclosure of Annual Reports

- WLL Companies: No

- Single Person Companies: No

- Bahraini Shareholding Company: Yes

- Foreign Branch: No

- Partnership Company: No

Banking in Bahrain

- Requirement for the Personal Presence of Shareholders to Open a Company Account: Yes

- Online Banking: Available

- Corporate Debit Card: Available for single-member companies

- Current Account: Available

- Savings Account: Available

- International Funds Transfer: Available

Regulatory Bodies

- Commercial Register: Ministry of Industry, Commerce & Tourism (MOIC)

- Commercial Law: Regulated by The Commercial Companies Law Bahrain DECREE LAW NO. (21) OF 2001

- Employment Regulation: Labour Market Regulatory Authority Bahrain (LMRA)

- Tax Regulation: National Bureau for Revenue (NBR)

Business Development Programs

- Incubation Centers: Available

- Business Development Loans: Available

- Govt Support Programs: Available

- Business Centers: Available

Foreign Ownership

- Individual Establishment: Allowed for Americans and GCC national foreign investors.

- Single Person Company: Allowed

- Partnership Company: Allowed

- With Limited Liability Company: Allowed

- Limited Partnership: Allowed

- Bahraini Shareholding Company (Joint Stock Company): Allowed

Choose Aventen Group Business Consultant for a comprehensive and hassle-free journey through company formation in Bahrain. Our expertise is your key to a successful business venture.

For Schedule A Call Fill the Given Form

Our Business Expert Will Call you back Shortly with Expert Business Guidance

Frequently Asked Questions (FAQs) -About Company Formation in Bahrain

Absolutely yes. The Kingdom of Bahrain welcomes and permits foreign ownership of companies, offering an inclusive environment for global entrepreneurs interested in company formation in Bahrain.

Yes, approximately 90% of the company formation procedure can be accomplished online. However, personal presence is required for the crucial step of opening a company bank account.

Typically, company formation in Bahrain can be completed in a swift 20-30 working days, ensuring a prompt start to your business journey.

The essential requirements for company formation in Bahrain include:

- Passport Copy.

- NOC (For employees in Bahrain only).

- Power of Attorney or E-key.

- Office Address (Electricity Account).

- Memorandum of Association.

- Capital Deposit Certificate.

The cost varies based on factors such as company type. For a typical With Limited Liability (WLL) company with the minimum capital requirement, the cost is approximately $2260. However, specialized commercial registrations may incur different costs.

Setting up a company in Bahrain grants each shareholder a “Businessman/Investor” resident permit, along with resident permits for their dependents (Spouse and Children). Initially, you can avail 2 work permits for your employees. This can be increased later by providing workload documentation to LMRA.

Yes, Bahrain offers a conducive business environment for foreign investors with its free zone structure, no geographical restrictions, and various business development programs.

Bahrain boasts a favorable tax environment with 0% corporate tax and 0% income tax, making it an attractive destination for businesses seeking financial advantages.

Bahrain provides flexibility in organizational structures. While there is no minimum shareholder requirement, the maximum number is unlimited, allowing for diverse ownership models.

Yes, companies in Bahrain can benefit from online banking facilities, providing convenience and flexibility in managing their financial transactions.

Bahrain offers various business development programs, including incubation centers, business development loans, government support programs, and accessible business centers.

Yes, unlike other Gulf countries, Bahrain imposes no geographical restrictions. The entire country operates as a free zone, allowing businesses to set up in any city.

Bahrain imposes no minimum capital requirement by law, providing flexibility for businesses to structure their capital as needed.

Debentures are allowed for Bahraini Shareholding Companies only, offering a financing option for this specific business structure.

Aventen Group Business Consultant specializes in guiding clients through Bahrain’s corporate landscape, offering startup advisory and personalized company formation services. Our team ensures a seamless and client-focused experience.